The Exam Breakdown in the Introduction shows how many questions will be on your exam, and how many of them will be allocated to each chapter on the practice tests and on the state exam. Consult this breakdown and manage your study time accordingly.

A list of Terms to Know at the beginning of each chapter will help you better understand important insurance-related concepts presented in the chapter. Sometimes, terms you are familiar with in regular life have a unique meaning when applied to insurance, so review these terms and definitions.

Study Tips

- Always take notes. This will help you to actively engage in the learning process and solidify concepts in your memory.

- If you are studying with the textbook, answer the Snapshot questions at the beginning of each chapter first on your own, and then confirm your answer in the text (the answers are also provided at the end of the Study Guide).

- Make a reference sheet. This will allow you to have a quick focused review at the end of a chapter or the course.

- If you are struggling with some concepts, take an open-book chapter quiz. This will encourage you to seek out answers, analyze information, and apply that knowledge. Once you have to work for it, you will remember and understand the concepts better.

- Take a break from studying. If you have been studying a lot, but feel like you’re having trouble remembering the information, take a couple of days off. When you return, Simulate Your Exam and see how you do. Go back and review any areas you have trouble with. Take notes!

- Keep the information fresh in your mind. Study up until the day before your exam. If you are unable to take the state exam right after you have completed your studies, you should re-start the study and review process. It is better to delay taking the exam than to take it unprepared.

F. Exam Breakdown

Tennessee Life Insurance Examination

82 Total Questions (68 scored, 14 pretest)

| Chapter | Percentage of Exam |

| GENERAL KNOWLEDGE: | |

Completing the Application, Underwriting, and Delivering the Policy | 18% |

Types of Life Policies | 18% |

Policy Provisions, Riders and Options | 26% |

| Taxes, Retirement, and Other Insurance Concepts | 12% |

| STATE LAW: | |

| Tennessee Laws, and Departmental Rules Common to All Lines | 20% |

| Tennessee Laws and Departmental Rules Pertinent to Life Insurance Only | 6% |

Accurate underwriting depends heavily on an application that is complete and representative of the potential risks. This chapter focuses on the producer's first major role as a field underwriter: completing the application and delivering the policy. This section discusses the specific steps of the application process, which includes completing the form itself, collecting the premium, and delivering the policy. In general, this chapter helps you build a foundation of insurance concepts that make it easier for you to master the rest of the material in this course.

TERMS TO KNOW | |

Adverse selection — insuring of risks that are more prone to losses than the average risk | |

A. Key Concepts and Definitions

Insurance is a transfer of risk of loss from an individual or a business entity to an insurance company, which, in turn, spreads the costs of unexpected losses to many individuals. If there were no insurance mechanism, the cost of a loss would have to be borne solely by the individual who suffered the loss.

| Know This! Insurance is the transfer of risk. Insureds' losses are transferred over to the insurer. |

The term insurance transaction includes any of the following (by mail or any other means):

- Solicitation;

- Negotiations;

- Sale (effectuation of a contract of insurance); and

- Advising an individual concerning coverage or claims.

B. Types of Insurers

Insurance companies can be classified in a variety of ways based on ownership, authority to transact business, location of incorporation (domicile), marketing and distribution systems, or rating (financial strength).

As you read about different classifications of insurers, keep in mind that these categories are not mutually exclusive, and the same company can be described based on where it is located and allowed to transact the business of insurance, who owns it, and what type of agents it appoints.

Stock companies are owned by the stockholders who provide the capital necessary to establish and operate the insurance company and who share in any profits or losses. Officers are elected by the stockholders and manage stock insurance companies. Traditionally, stock companies issue nonparticipating policies, in which policyowners do not share in profits or losses.

A nonparticipating (stock) policy does not pay dividends to policyowners; however, taxable dividends are paid to stockholders.

Mutual companies are owned by the policyowners and issue participating policies. With participating policies, policyowners are entitled to dividends, which, in the case of mutual companies, are a return of excess premiums and are, therefore, nontaxable. Dividends are generated when the premiums and the earnings combined exceed the actual costs of providing coverage, creating a surplus. Dividends are not guaranteed.

Before insurers may transact business in a specific state, they must apply for and be granted a license or Certificate of Authority from the state department of insurance and meet any financial (capital and surplus) requirements set by the state. Insurers who meet the state's financial requirements and are approved to transact business in the state are considered authorized or admitted into the state as a legal insurer. Those insurers who have not been approved to do business in the state are considered unauthorized or nonadmitted. Most states have laws that prohibit unauthorized insurers from conducting business in the state, except through licensed excess and surplus lines brokers.

| Know This! Insurers must obtain a Certificate of Authority prior to transacting business in this state. |

Domicile of Insurer: Insurers can also be defined by their location of incorporation and whether or not they are authorized to write business in a state. The insurer's domicile, or location of incorporation, will determine whether an insurance company is considered domestic, foreign or alien. In the state they are incorporated in, they are considered a domestic insurer. If the insurer is operating in a state other than the one they are incorporated in, they are called a foreign insurer. If the insurer is incorporated outside the United States, they are considered an alien insurer.

C. Contract Law

A contract is an agreement between two or more parties enforceable by law. Because of unique aspects of insurance transactions, the general law of contracts had to be modified to fit the needs of insurance.

1. Elements of a Legal Contract

In order for insurance contracts to be legally binding, they must have 4 essential elements:

- Agreement — offer and acceptance;

- Consideration;

- Competent parties; and

- Legal purpose.

Offer and Acceptance

There must be a definite offer by one party, and the other party must accept this offer in its exact terms. In insurance, the applicant usually makes the offer when submitting the application. Acceptance takes place when an insurer’s underwriter approves the application and issues a policy.

Consideration

The binding force in any contract is the consideration. Consideration is something of value that each party gives to the other. The consideration on the part of the insured is the payment of premium and the representations made in the application. The consideration on the part of the insurer is the promise to pay in the event of loss.

| Know This! Insurer's consideration is the promise to pay for losses; insured's consideration is the premium and statements on the application. |

Competent Parties

The parties to a contract must be capable of entering into a contract in the eyes of the law. Generally, this requires that both parties be of legal age, mentally competent to understand the contract, and not under the influence of drugs or alcohol.

Legal Purpose

The purpose of the contract must be legal and not against public policy. To ensure legal purpose of a Life Insurance policy, for example, it must have both: insurable interest and consent. A contract without a legal purpose is considered void, and cannot be enforced by any party.

2. Distinct Characteristics of an Insurance Contract

Contract of Adhesion

A contract of adhesion is prepared by one of the parties (insurer) and accepted or rejected by the other party (insured). Insurance policies are not drawn up through negotiations, and an insured has little to say about its provisions. In other words, insurance contracts are offered on a take-it-or-leave-it basis by an insurer. Any ambiguities in the contract will be settled in favor of the insured.

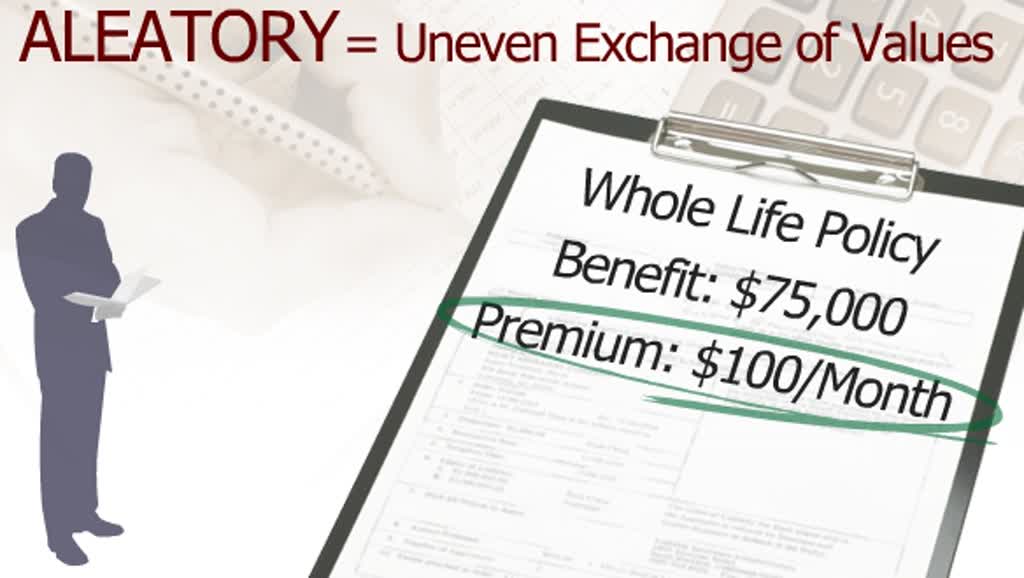

Aleatory Contract

Insurance contracts are aleatory, which means there is an exchange of unequal amounts or values. The premium paid by the insured is small in relation to the amount that will be paid by the insurer in the event of loss.

Life and Health Example:

John purchases a life insurance policy for $100,000. His monthly premium is $100. If John only had the policy for 2 months, which means he only paid $200 in premiums, and he unexpectedly died, his beneficiary will receive $100,000. A $200 contribution on the part of the insured in exchange for $100,000 benefit from the insurer illustrates an aleatory contract.

Property and Casualty Example:

John purchases a homeowners insurance policy for $100,000. His monthly premium is $100. If John only had the policy for 2 months, which means he only paid $200 in premiums, and the home was unexpectedly destroyed by a covered peril, John will receive $100,000. A $200 contribution on the part of the insured in exchange for $100,000 benefit from the insurer illustrates an aleatory contract.

Unilateral Contract

In a unilateral contract, only one of the parties to the contract is legally bound to do anything. The insured makes no legally binding promises. However, an insurer is legally bound to pay losses covered by a policy in force.

Conditional Contract

As the name implies, a conditional contract requires that certain conditions must be met by the policyowner and the company in order for the contract to be executed, and before each party fulfills its obligations. For example, the insured must pay the premium and provide proof of loss in order for the insurer to cover a claim.

3. Representations and Warranties

A warranty is an absolutely true statement upon which the validity of the insurance policy depends. Breach of warranties can be considered grounds for voiding the policy or a return of premium. Because of such a strict definition, statements made by applicants for life and health insurance policies, for example, are usually not considered warranties, except in cases of fraud.

Representations are statements believed to be true to the best of one's knowledge, but they are not guaranteed to be true. For insurance purposes, representations are the answers the insured gives to the questions on the insurance application.

Untrue statements on the application are considered misrepresentations and could void the contract. A material misrepresentation is a statement that, if discovered, would alter the underwriting decision of the insurance company. Furthermore, if material misrepresentations are intentional, they are considered fraud.

D. Completing the Application

The Application is the starting point and basic source of information used by the company in the risk selection process. Although applications are not uniform and may vary from one insurer to another, they all have the same basic components: Part 1 - General Information and Part 2 - Medical Information.

Part 1 - General Information of the application includes the general questions about the applicant, such as name, age, address, birth date, gender, income, marital status, and occupation. It will also inquire about the existing policies and if the proposed insurance will replace them. Part 1 identifies the type of policy applied for and the amount of coverage, and usually contains information concerning the beneficiary.

Part 2 - Medical Information of the application includes information on the prospective insured's medical background, present health, any medical visits in recent years, medical status of living relatives, and causes of death of deceased relatives. If the amount of insurance is relatively small, the agent and the proposed insured will complete all of the medical information. That would be considered a nonmedical application. For larger amounts, the insurer will usually require some sort of medical examination by a professional.

It is the agent’s responsibility to make certain that the application is filled out completely, correctly, and to the best of the applicant's knowledge. The agent must probe beyond the stated questions in the application if he or she has any reason to believe the applicant is misrepresenting or concealing information, or does not understand the specific questions asked. Any information that is misleading, inaccurate or illegible may delay the issuance of the policy. If the agent feels that there could be some misrepresentation, he/she must inform the insurance company. Some insurers require that the applicant complete the application under the agent’s watchful eye, while other insurers require that the agent complete the application in order to help avoid mistakes and unanswered questions.

The agent is the company's front line, and is referred to as a field underwriter because the agent is usually the one who has solicited the potential insured. As a field underwriter, the agent has many important responsibilities during the underwriting process and beyond, including the following:

- Proper solicitation of applicants;

- Helping prevent adverse selection;

- Completing the application;

- Obtaining the required signatures;

- Collecting the initial premium and issuing the receipt, if applicable; and

- Delivering the policy.

As a field underwriter, the agent (or producer) can be considered the most important source of information available to the company underwriters. The agent's report provides the agent's personal observations concerning the proposed insured. The agent's report does not become a part of the entire contract, although it is a part of the application process.

1. Required Signatures

Both the agent and the proposed insured (usually the applicant) must sign the application. If the proposed insured and the policyowner are not the same person, such as a business purchasing insurance on an employee, then the policyowner must also sign the application. An exception to the proposed insured signing the application would be in the case of an adult, such as a parent or guardian, applying for insurance on a minor child.

2. Changes in the Application

When an answer to a question on the application needs to be corrected, agents have the option, depending on which insurer they represent, of correcting the information and having the applicant initial the change, or completing a new application. An agent should never erase or white out any information on an application for insurance.

3. Consequences of Incomplete Applications

Before a policy is issued, all of the questions on the application must be answered. If the insurer receives an incomplete application, the insurer must return it to the applicant for completion. If a policy is issued with questions left unanswered, the contract will be interpreted as if the insurer waived its right to have an answer to the question. The insurer will not have the right to deny coverage based on any information that the unanswered question might have contained.

4. Collecting the Initial Premium and Issuing the Receipt

Most agents attempt to collect the initial premium and submit it along with the application to the insurer. In addition, collecting the initial premium at the time of the application increases the chance that the applicant will accept the policy once it is issued. Whenever the agent collects premiums, the agent must issue a premium receipt. The type of receipt issued will determine when coverage will be effective.

The most common type of receipt is a conditional receipt, which is used only when the applicant submits a prepaid application. The conditional receipt says that coverage will be effective either on the date of the application or the date of the medical exam, whichever occurs last, as long as the applicant is found to be insurable as a standard risk, and policy is issued exactly as applied for. This rule will not apply if a policy is declined, rated, or issued with riders excluding specific coverages.

Example:

If an agent collects the initial premium from an applicant and gives the applicant a conditional receipt, and the applicant dies the next day, the underwriting process will proceed as though the applicant were still alive. If the insurer ends up approving the coverage, then the applicant's beneficiary will receive the death benefit of the policy. If, on the other hand, the insurer determines that the applicant was not an acceptable risk and declines the coverage, the premium will be refunded to the beneficiary, and the insurer is not required to pay the death benefit.

5. Replacement

Replacement is a practice of terminating an existing policy or letting it lapse, and obtaining a new one. To make sure that replacement is appropriate and in the best interests of the policyowner, insurance producers and companies must take special underwriting measures to help policyowners make informed decisions.

E. Underwriting

Underwriting is the risk selection and classification process. It involves a careful analysis of many different factors to determine the acceptability of applicants for insurance. In other words, underwriting is the process in which an insurance company determines whether or not a particular applicant is insurable, and if so, what premium to charge.

The agent is the company's front line, and is referred to as a field underwriter because the agent is usually the one who has solicited the potential insured. As a field underwriter, the agent has many important responsibilities, including the following:

- Helping prevent adverse selection;

- The proper solicitation of applicants;

- Completing the application;

- Obtaining the required signatures;

- Collecting the initial premium and issuing the receipt, if applicable; and

- Delivering the policy.

1. Insurable Interest

To purchase insurance, the policyowner must face the possibility of losing money or something of value in the event of loss. This is called insurable interest. In life insurance, insurable interest must exist between the policyowner and the insured at the time of application; however, once a life insurance policy has been issued, the insurer must pay the policy benefit, whether or not an insurable interest exists.

A valid insurable interest may exist between the policyowner and the insured when the policy is insuring any of the following:

- Policyowner's own life;

- The life of a family member (a spouse or a close blood relative); or

- The life of a business partner, key employee, or someone who has a financial obligation to the policyowner (such as debtor to a creditor).

Insurable interest is not required of beneficiaries. Since the beneficiary's well-being is dependent upon the insured, and the beneficiary's life is not the one being insured, the beneficiary does not have to show an insurable interest for a policy to be purchased.

| Know This! Insurable interest must exist at the time of application. |

| Know This! The policyowner must have insurable interest in the life of the insured. |

2. Sources of Underwriting Information

In order to properly select and classify insurance risks, the insurer needs to obtain the applicants' background information and medical history. There are several sources of underwriting information that are available to the underwriters.

Application

The person applying for insurance must submit an application to the insurer for approval for a policy to be issued. The application is one of the main sources of underwriting information for the company.

| Know This! An insurance application is the key source underwriters use for information about the applicant. |

Agent's Report

The agent's report allows the agent to communicate with the underwriter and provide information about the applicant known by the agent that may assist in the underwriting process.

Investigative Consumer Report (Inspection)

To supplement the information on the application, the underwriter may order an inspection report on the applicant from an independent investigating firm or credit agency, which covers financial and moral information. They are general reports of the applicant's finances, character, work, hobbies, and habits. Companies that use inspection reports are subject to the rules and regulations outlined in the Fair Credit Reporting Act.

Fair Credit Reporting Act

The Fair Credit Reporting Act established procedures that consumer-reporting agencies must follow in order to ensure that records are confidential, accurate, relevant, and properly used. The law also protects consumers against the circulation of inaccurate or obsolete personal or financial information.

The acceptability of a risk is determined by checking the individual risk against many factors directly related to the risk's potential for loss. Besides these factors, an underwriter will sometimes request additional information about a particular risk from an outside source. These reports generally fall into 2 categories: Consumer Reports and Investigative Consumer Reports. Both reports can only be used by someone with a legitimate business purpose, including insurance underwriting, employment screening, and credit transactions.

Consumer reports include written and/or oral information regarding a consumer's credit, character, reputation, or habits collected by a reporting agency from employment records, credit reports, and other public sources.

Investigative Consumer Reports are similar to consumer reports in that they also provide information on the consumer's character, reputation, and habits. The primary difference is that the information is obtained through an investigation and interviews with associates, friends and neighbors of the consumer. Unlike consumer reports, these reports cannot be made unless the consumer is advised in writing about the report within 3 days of the date the report was requested. The consumers must be advised that they have a right to request additional information concerning the report, and the insurer or reporting agency has 5 days to provide the consumer with the additional information.

The reporting agency and users of the information are subject to civil action for failure to comply with the provisions of the Fair Credit Reporting Act. A person who knowingly and willfully obtains information on a consumer from a consumer reporting agency under false pretenses may also be fined and/or imprisoned for up to 2 years.

An individual who unknowingly violates the Fair Credit Reporting Act is liable in the amount equal to the loss to the consumer, as well as any reasonable attorney fees incurred in the process.

An individual who willfully violates this Act enough to constitute a general pattern or business practice will be subject to a penalty of up to $2,500.

Under the Fair Credit Reporting Act, if a policy of insurance is declined or modified because of information contained in either a consumer or investigative report, the consumer must be advised and provided with the name and address of the reporting agency. The consumer has the right to know what was in the report. The consumer also has a right to know the identity of anyone who has received a copy of the report during the past year. If the consumer challenges any of the information in the report, the reporting agency is required to reinvestigate and amend the report, if warranted. If a report is found to be inaccurate and is corrected, the agency must send the corrected information to all parties to which they had reported the inaccurate information within the last 2 years.

Consumer reports cannot contain certain types of information if the report is requested in connection with a life insurance policy or credit transaction of less than $150,000. The prohibited information includes bankruptcies more than 10 years old, civil suits, records of arrest or convictions of crimes, or any other negative information that is more than 7 years old. As defined by the Act, negative information includes information regarding a customer's delinquencies, late payments, insolvency or any other form of default.

Medical Information Bureau (MIB)

In addition to an attending physician's report, the underwriter will usually request a Medical Information Bureau (MIB) report.

The MIB is a membership corporation owned by member insurance companies. It is a nonprofit trade organization which receives adverse medical information from insurance companies and maintains confidential medical impairment information on individuals. It is a systematic method for companies to compare the information they have collected on a potential insured with information other insurers may have discovered. The MIB can be used only as an aid in helping insurers know what areas of impairment they might need to investigate further. An applicant cannot be refused simply because of some adverse information discovered through the MIB.

| Know This! Insurers cannot refuse coverage solely on the basis of adverse information on an MIB report. |

Medical Examinations

For policies with higher amounts of coverage or if the application raised additional questions concerning the prospective insured's health, the underwriter may require a medical examination of the insured. There are two options, depending on the reason for the medical examination:

- The insurer may only request a paramedical report which is completed by a paramedic or a registered nurse; and

- The underwriter may require an Attending Physician's Statement (APS) from a medical practitioner who treated the applicant for a prior medical problem.

Medical examinations, when required by the insurance company, are conducted by physicians or paramedics at the insurance company's expense. Usually such exams are not required with regard to health insurance, thus stressing the importance of the agent in recording medical information on the application. The medical exam requirement is more common with life insurance underwriting. If an insurer requests a medical examination, the insurer is responsible for the costs of the exam.

It is common among insurers to require an HIV test when an applicant is applying for a large amount of coverage, or for any increased and additional benefits. To ensure proper obtaining and handling of results, and to protect the insured's privacy, states have enacted the following laws and regulations for insurers requiring an applicant to submit to an HIV test:

- The insurer must disclose the use of testing to the applicant, and obtain written consent from the applicant on the approved form;

- The insurer must establish written policies and procedures for the internal dissemination of test results among its producers and employees to ensure confidentiality.

HIPAA

The Health Insurance Portability and Accountability Act (HIPAA) is a federal law that protects health information. HIPAA regulations provide protection for the privacy of certain individually identifiable health information (such as demographic data that relates to physical or mental health condition, or payment information that can identify the individual), referred to as protected health information. Under the Privacy Rule, patients have the right to view their own medical records, as well as the right to know who has accessed those records over the previous 6 years. The Privacy Rule, however, allows disclosures without individual authorization to public health authorities authorized by law to collect or receive the information for the purpose of preventing or controlling disease, injury, or disability.

Use and Disclosure of Insurance Information

Every applicant for a life insurance policy must be given a written disclosure statement that provides basic information about the cost and coverage of the insurance being solicited. This disclosure statement must be given to the applicant no later than the time the application for insurance is signed. Disclosure statements will help the applicants to make more informed and educated decisions about their choice of insurance.

When insurers plan to seek and use information from investigators, they must first provide the applicant/insured with a written Disclosure Authorization Notice. It will state the insurer's practice regarding collection and use of personal information. The disclosure authorization form must be written in plain language, and must be approved by the head of the Department of Insurance.

3. Risk Classification

In classifying a risk, the Home Office underwriting department will look at the applicant’s past medical history, present physical condition, occupation, habits and morals. If the applicant is acceptable, the underwriter must then determine the risk or rating classification to be used in deciding whether or not the applicant should pay a higher or lower premium. A prospective insured may be rated as one of the three classifications: standard, substandard, or preferred.

| Know This! The higher the risk, the higher the premium. |

Preferred risks are those individuals who meet certain requirements and qualify for lower premiums than the standard risk. These applicants have a superior physical condition, lifestyle, and habits.

Standard risks are persons who, according to a company’s underwriting standards, are entitled to insurance protection without extra rating or special restrictions. Standard risks are representative of the majority of people at their age and with similar lifestyles. They are the average risk.

Substandard (High Exposure) risk applicants are not acceptable at standard rates because of physical condition, personal or family history of disease, occupation, or dangerous habits. These policies are also referred to as "rated" because they could be issued with the premium rated-up, resulting in a higher premium.

Applicants who are rejected are considered declined risks. Risks that the underwriters assess as not insurable are declined. For example, a risk may be declined for one of the following reasons:

- There is no insurable interest;

- The applicant is medically unacceptable;

- The potential for loss is so great it does not meet the definition of insurance; or

- Insurance is prohibited by public policy or is illegal.

4. Stranger-originated Life Insurance (STOLI) and Investor-originated Life Insurance (IOLI)

Stranger-originated life insurance (STOLI) is a life insurance arrangement in which a person with no relationship to the insured (a "stranger") purchases a life policy on the insured's life with the intent of selling the policy to an investor and profiting financially when the insured dies. In other words, STOLIs are financed and purchased solely with the intent of selling them for life settlements.

STOLIs violate the principle of insurable interest, which is in place to ensure that a person purchasing a life insurance policy is actually interested in the longevity rather than the death of the insured. Because of this, insurers take an aggressive legal stance against policies they suspect are involved in STOLI transactions.

Note that lawful life settlement contracts do not constitute STOLIs. Life settlement transactions result from existing life insurance policies; STOLIs are initiated for the purpose of obtaining a policy that would benefit a person who has no insurable interest in the life of the insured at the time of policy origination.

Investor-owned life insurance (IOLI) is another name for a STOLI, where a third-party investor who has no insurable interest in the insured initiates a transaction designed to transfer the policy ownership rights to someone with no insurable interest in the insured and who hopes to make a profit upon the death of the insured or annuitant.

F. Delivering the Policy

Once the underwriting process has been completed and the company issues the policy, the agent will deliver it to the insured. Although personal delivery of the insurance policy is the best method of finalizing the insurance transaction, mailing the policy directly to the policyowner is acceptable. When the insurer relinquishes control of the policy by mailing it to the policyowner, policy is considered legally delivered. However, it is advisable to obtain a signed delivery receipt.

1. Explaining the Policy and its Provisions, Riders, Exclusions, and Ratings to the Client

Personal delivery of the policy allows the agent an opportunity to make sure that the insured understands all aspects of the contract. Review of the contract with the insured involves pointing out provisions or riders that may be different than anticipated, and explaining what effect they have on the contract. In addition, the agent should explain the rating procedure to the client, especially if the policy is rated differently than applied for, or has been modified or amended in any other way. The agent should also explain any other choices and provisions available to the policyowner that may become active at this time.

A buyer’s guide provides basic, generic information about life insurance policies that contains, and is limited to, language approved by the Department of Insurance. This document explains how a buyer should go about choosing the amount and type of insurance to buy, and how a buyer can save money by comparing the costs of similar policies. Insurers must provide a buyer's guide to all prospective policy applicants prior to accepting their initial premium. If the policy contains an unconditional refund provision of at least 10 days (free-look period), a buyer's guide can be delivered with the policy.

A policy summary is a written statement describing the features and elements of the policy being issued. It must include the name and address of the agent, the full name and home office or administrative office address of the insurer, and the generic name of the basic policy and each rider. A policy summary will also include premium, cash value, dividend, surrender value and death benefit figures for specific policy years. The policy summary must be provided when the policy is delivered.

| Know This! A buyer's guide provides generic information on various types of policies. A policy summary provides specific information on the policy being issued. |

The term illustration means a presentation or depiction that includes nonguaranteed elements of a policy of individual or group life insurance over a period of years. A life insurance illustration must do the following:

- Distinguish between guaranteed and projected amounts;

- Clearly state that an illustration is not a part of the contract; and

- Identify those values that are not guaranteed as such.

An agent may only use the illustrations of the insurer that have been approved, and may not change them in any way.

2. When Coverage Begins

If the initial premium is not paid with the application, the agent will be required to collect the premium at the time of policy delivery. In this case, the policy does not go into effect until the premium has been collected. The agent may also be required to get a statement of good health from the insured. This statement must be signed by the insured, and verifies that the insured has not suffered injury or illness since the application date.

If the full premium was submitted with the application and the policy was issued as requested, the policy coverage would generally coincide with the date of application if no medical exam is required. If a medical exam is required, the date of the coverage will coincide with the date of the exam.

| Know This! NO premium, NO coverage. |

G. USA PATRIOT Act and Anti-Money Laundering

The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act, also known as the USA PATRIOT Act was enacted on October 26, 2001. The purpose of the Act is to address social, economic, and global initiatives to fight and prevent terrorist activities. The Act enabled the Financial Crime Enforcement Network (FinCEN) to require banks, broker-dealers, and other financial institutions to establish new anti-money laundering (AML) standards. With new rules in place, FinCEN incorporated the insurance industry into this group.

To secure the goals of the Act, FinCEN has implemented an AML Program that requires the monitoring of all financial transactions and reporting of any suspicious activity to the government, along with prohibiting correspondent accounts with foreign shell banks. A comprehensive customer identification and verification procedure is also to be set in place. The AML program consists of the following minimum requirements:

- Assimilate policies, procedures and internal controls based on an in-house risk assessment, including:

- Instituting AML programs similar to banks and securities lenders; and

- File suspicious activity reports (SAR) with Federal authorities;

- Appointing a qualified compliance officer responsible for administering the AML program;

- Continual training for applicable employees, producers and other; and

- Allow for independent testing of the program on a regular basis.

1. Suspicious Activity Reports (SARs) Rules

Any company that is subject to the AML Program is also subject to SAR rules. SAR rules state that procedures and plans must be in place and designed to identify activity that one would deem suspicious of money laundering, terrorist financing and/or other illegal activities. Deposits, withdrawals, transfers or any other business deals involving $5,000 or more are required to be reported if the financial company or insurer “knows, suspects or has reason to suspect” that the transaction:

- Has no business or lawful purpose;

- Is designed to deliberately misstate other reporting constraints;

- Uses the financial institution or insurer to assist in criminal activity;

- Is obtained using fraudulent funds from illegal activities; or

- Is intended to mask funds from other illegal activities.

Some "red flags" to look for in suspicious activity:

- Customer uses fake ID or changes a transaction after learning that he or she must show ID;

- Two or more customers use similar IDs;

- Customer conducts transactions so that they fall just below amounts that require reporting or recordkeeping;

- Two or more customers seem to be working together to break one transaction into two or more (trying to evade the Bank Secrecy Act (BSA) requirements); or

- Customer uses two or more money service business (MSB) locations or cashiers on the same day to break one transaction into smaller transactions (trying to evade BSA requirements).

Relevant SAR reports must be filed with FinCEN within 30 days of initial discovery. Reporting takes place on FinCEN Form 108.

H. Chapter Recap

This chapter explained some of the basic principles and processes of life insurance underwriting. Let's recap them:

GENERAL CONCEPTS | |

Insurance |

|

Insurable Interest |

|

INSURANCE CONTRACTS | |

| Elements of a Legal Contract |

|

| Contract Characteristics |

|

PROCESS OF ISSUING A LIFE INSURANCE POLICY | |

Underwriting | Field Underwriting (by agent)

Company Underwriting

Federal Regulations

|

Premium Determination |

|

Policy Issue and Delivery |

|

Chapter: Completing the Application, Underwriting, and Delivering the Policy

page 2- Multi-Media Learning Activities

- Key Concepts

- Handling Risk and Insurable Risk

- Elements of a Legal Contract

- Nature of Insurance Contracts

- Other Contract Features

- Purchase of Life Insurance

- Insurable Interest

- Process of Issuing Insurance Policies

- Policy Summary vs. Buyer's Guide

- Policy Application

- Underwriting - Key Concepts

- Adverse Selection

- Sources of Underwriting Information

- Receipts

- Classification of Risk

- Premium Payment and Policy Delivery

- Principles of Insurance - ListenUp!

- Flash Cards - Completing the Application, Underwriting, and Delivering the Policy

Insurance is the transfer of risk. responsible for managing and handling the burden of a large cost. the transfer of risk from an individual to a company. pay the premium, and they are contracturally obligated to pay a claim as long as the policy is in good order.

types of risk.

pure risk is the only type of risk that can be insured. loss only, no financial gain. you only have a chance of loss.

speculative riks, you could have a loss or financial gain. gambling. you can never insure speculative risk.

types of hazards. a hazard is something that increases your possibility of having a loss.

the relationship of a peril to a loss. peril is the cause of a loss. the reason for loss. in life insurance the peril is death. medical expense plan it is sickness or accidental injury.

loss is defined as a reduction in value, a basis for a claim. pass away, decedent's beneficiary will file a death claim with the company to notify them. company receives the claim, processes it, because the insured had prepared for this kind of event, transferred risk of premature death to company, now they will pay death benefit to beneficiary.

| hazards | perils | loss | insurance | conditions that increase the probability of an insured loss | cause of loss | reduction of value | transfer of loss | protection |

handling risk

there are a number of ways that individuals can handle risk.

- avoidance

- retention

- sharing

- reduction

- transfer

sharing is similar to transferring and has to do with how insurance company is structured. some members of certain types of insurance providers, are said to share in the risk of the group; a little different from transferring.

when you reduce your risk (quitting smoking, losing weight) reducing exposure to risks that are out there, improve situation.

transfer is what you do with insurance. transfer the burden of the risk of financial loss to the insurance company. pay a premium and the company is contracturally obligated to pay a claim as long as the policy is good.

5 different elements that make up insurable risk. not intentional. what actuaries do on behalf of company. look at person and compare. method. can't insure a situation or person that presents so much risk that the company could be put at risk of becoming overextended. business must be profitable. risks must be appropriate.

- due to chance

- definite and measurable

- statisticaly predictable

- not catastrophic

- randomly selected; large loss exposure

law of large numbers. the larger the group the more accurately the actuaries can statistically figure the kinds of losses a person presents to the company.

elements of a legal contract

all insurance policies are contracts. there is 4 elements agreement between 2 parties company and policy owner. the agreement starts out with the proposed insured or owner of the policy completing an application. the offer. accepted by company when issue a policy. consideration, insurer consideration is the cash they would pay out in a claim. on the policy owner's side it's 2 part: cash that is paid in premiums, and their answers on the application; on life insurance, called representations. true to the best of your knowledge at the time. competant parties should not be under the influence of alchohol nor narcotics. contracts have to be created for a legal purpose. you cannot enter into a contract to try to insure something that is against the law.

- agreement; offer, application; acceptance, issued policy

- consideration

- competant parties; legal age, mentally competant, sober

- legal purpose; not against public policy

nature of insurance contracts

other contract features

application statements, most answeres are going to be representations. truth to the best of knowledge. warranties, 100% absolute truth. e.g. homeowner's policy will reduce your premium if you have smoke detectors and fire extinguishers and sprinklers. signing the app is a warranty, first thing they will check if they are really there and in working order, else it voids the claim.

- warranties

- absolutely true statements

- breach of warranties can void the policy

- representations

- statements by the applicant, true to best of knowledge

- not guaranteed to be true

fraud & concealment. fraud is the intentional misrepresentation of a material fact. can void out your contract.

- fraud: intentional misrepresentation of a material fact, made with intent to deceive; an act of deceit or cheating.

- concealment: intentional withholding of information of a material fact that is crucial in making an underwriting decision.

- material fact: a fact that would lead to a different decision had the insurer known about it.

utmost good faith. comes into play when you are making a sale and the proposed insured is answering those questions on the applicaion. assuming the client is answering truthfully. client is assuming that the agent giving them full, concise, complete information about the product that they are buying. make proper decisions about the contract about to go into being.

purchase of life insurance

insurance basics. flow. responsibility. policy owner controlls the policy.

- policy owner pays the premium

- insurance company issues policy to policyowner and pays benefit to beneficiary.

- beneficiary receives federal income tax-free benefit upon insured's death.

insurable interest

have to prove insurable interest at the time of the application. valid insurable interest may exist between the policyowner and the insured when the policy is insuring any of the following:

- policyowner's own life

- life of a family member

- life of a business partner, key employee, or someone who has a financial obligation to the policyowner

"blood and business" insurable interest.

self, spouse, children.

business partners, employees, debtors

process of issuing insurance policies

solicitation and sales presentations. agent finds customers, sell the product, complete the application proposed insured, collect the premium check, get it all up to the home office. where majority of underwriting takes place.

underwriting field and company. sitting down with a client, asking the questions, getting to know them, observing them. agent field underwriter. the person the client sees and the home office relies on.

premium determination. what should be charged for coverage.

policy issue and delivery. go to the client to get assent for the offer. issue the policy to the agent, deliver it to the client.

policy summary vs. buyer's guide

used as educational tool to give to the customer, explains insurance in general, types they may be interested in buying to cost compare.

- buyer's guide

- generic information about insurance policies

- helps compare policies

- usually provided at the time of application

- basic information about similar policies

- cost comparison for similar policies

document has several names: illustration, hypothetical. the selling tool you create based on criteria, parameters. age, gender, this much death benefit, if we run you as a standard risk, this is what it could look like. selling intangible racket.

- policy summary

- specific information about policy being issued

- usually provided prior to or at policy delivery

- agent's name, address

- insurer's full name

- general name of policy

- premium

- each rider

- living benefits

- surrender values

when you send application in to the home office you send a copy of the summary illustration. home office knows exactly what product with what features you sold.

policy application

parts of the application. 3 parts.

part 1 general information

part 2 medical information

agent's report. your observations. so the underwirter can get a better feel. perhaps a 70yr old woman golfs twice a week, walks 2 miles a day, is really healthy vs a couch potato. personal. get all signatures. all changes have to be signed off. have to be taken back to the client. new business dept. at home office. make sure all inforation is answered or it will be sent back. because if an insurance company issues the policy with an incomplete application, they can never ask for the information. need full disclosure.

underwriting - key concepts

underwriting is the risk selection and classification proces

underwriter decides if a client is insurable; what premium to charge. primary criteria:

field underwriting is what agents do. sitting down with the client, getting them to fill out the application, talking to them. eyes and ears for the company. important responsibilities:

adverse selection

insuring of risks that are more prone to losses than the average risk. insurers protect themselves against adverse selection by refusing or restricting coverge for bad risks or by charging a higher rate.

law of large numbers. insurance is the spreading of risk among a large pool of people with similar exposure to loss. actuaries are statisticians.

the larger the number of people with a similar exposure to loss, the more predictable actual losses will be. the more comfortable the company will be insuring the person.

sources of underwriting information

attending physician statements (aps)

medical Information bureau (mib)

consumer reports and investigative consumer reports

fair credit reporting act has 2 parts: pre-notification and post-notification. a disclosure on the application telling the client that a credit report or investigative is needed. they don't do this all the time. signed to allow. post-notification if the company needs it, must tell the client that one was done. provide company that was used contact information to request report results. agent doesn't see it, goes to underwriting dept. client has to reach out to credit bureau.

investigative consumer report- similar to consumer report, but additional information is obtained through an investogation and interviews with associates, friends, or neighbors of the consumer (insured). consumer must be advised in writing about the report within 3 days of request. an inspection report on the applicant from an independent investigating firm or credit agency that covers financial and moral information

another paperwork that is part of the application process is the HIV consent. the insurer provides 2 forms: one asking permission and the other filled out with the doctor contact information. if there is a positive result, the medical professional contacts client to discuss results. not the agent's responsibility. insurer's duties

hiv consent requrement is not unfair discrimination if the following conditions are met: class is group of people of the same age and gender and smoker. false positives happen.

receipts

the basic type of premium reciept, upon completing the application, the client writes the check, on the very bottom of the very last page is a perforated section that you fill in the date, the dollar amount of the check, the face amount of the policy; then you tear it off and give it to the client. the type of receipt issued when premiums are collected with the application.

conditional receipt states that coverage will be effective either on the date of application or the date of the medical exam, whichever occurs last, as long as the policy is issued as applied for. application is beginning, underwriting process is completed and determination is made if the client is an accetable risk; medical exam is last. then coverage becomes effective.

classification of risk

three types. preferred always has cheapest rates. have to meet proper criteria:

healthy, non smoker, exercise. reduced risk of loss, covered at reduced rate.

average exposures, covered at standard rate. most people. not extremly high.

below the average, highest risk, covered at increased rates. complicated medical history, age, weight to height ratio, bad habits.

declined, too high a risk, not coverable

premium payment and policy delivery

mode of premium payment. how frequently payments will be made. higher frequency = higher premium

test questions will be based on annual payments

4 choices

| annual | $100 | $100 |

| semiannual | $51 | $102 |

| quarterly | $26 | $104 |

| monthly | $9 | $108 |

monthly is done through bank drafts but is more costly, because of processing fees.

how when you pay the premium affects the effective date of the policy; agent, go out, sit down, take an application, collect check, deliver to home office, processed, accepted, good risk, make offer, send policy, deliver it. effective date is the date of the check. you may have times when you don't take a premium check at the time of application, til risk is figured out, then premium amount is known, til underwriting process is completed, take offer to client, accepted, let company know, issue the policy, send it to agent, deliver the policy, collect the premium. additional document needed, insured signs attest to continued good health. the date you delivered the policy, picking up the check, effective date of policy.

Policy backdating. it's a process you can use to help save age, if someone is younger they could have a cheaper premuim. backdate a policy to be effective at a younger age.

premuim check has to be paid at the time. you could save the client money.

principals of insurance

insurance policies in general. contracts.

Before we sort out all of the different types of policies. Let's take a step back and look at insurance policies in general. These aren't just agreements their bona fide contracts, which means that the promises and right stated in the policy are protected by law the applicant promises to fill out the application as accurately as possible and to pay the required premiums in return the insurance company promises to pay a certain benefit. These legal promises are called consideration. I remember that my house Track was written by someone else and all I had to do was sign some paperwork how our insurance contracts different actually they're handled in pretty much the same way. The Ancients job is to explain the policy and to make sure that the application is filled out accurately as you can imagine. The application is very important because Cuz it's company. What and how much the premium should cost? When the contract is issued its delivered by the agent and the Some weight on the application what if the person lies or accidentally writes the wrong information? Then the insurance company could end up issuing a policy that should be issued at all under any safeguards against this absolutely if an applicant blatantly lies about something major on an application like conveniently forgetting to mention a history of heart attacks than the policy can actually be avoided this false information is called a misrepresentation small misrepresentations might result in an adjustment of benefits. The big ones can actually be grounds for terminating a policy. This is assuming however that the insurance company finds out about the light before the incontestability period begins. What's the incontestability period after a certain amount of time usually two years the statements on an application can't be contested by the insurer. The insurance company would have to honor these claims instead of adjusting or voiding the policy. That's harsh it is that's why we have additional ways of assessing. Person's health and lifestyle for one thing. We can require medical examinations before a policy is issued. And for another thing we can order a report from the medical information Bureau this organizations hold all of the information that fellow ensures have obtained about a person. So if I ask the MIB to send me a report about you, I'll see what kinds of losses other insurers have covered in the past and a history of heart attacks would definitely show up in report like that. All right. Now answer me this let's say that I interview someone who says that he's in perfect health, but I know it's a box of blood sugar testing supplies sitting on the table. When I asked him about this he refuses to give me a straight answer. What would I do? Could I offer the application? Excellent question, you're not allowed to alter the application in any way whatsoever. You'd be asking for big trouble. If you did you can however list your observations in a document called the agents report. This is a report that you right. Turn in with the application. It gives you a chance to voice your opinions and observations. If you see some major red flags, this is how you can report them and who reads the agents report Underwriters these folks make all of the decisions about what is or is not going to be in the contract. Their job is to answer two basic questions first. Are they going to issue a policy to begin with? If so what premium amount will they charge? No, I know that people can pay the first Premium when they turn in the application, how is the price determined? The agent will quote a price from a chart based on the company's normal underwriting criteria or the premium can be paid when the policy is delivered. The bottom line is that the coverage can't start until the agent or insurance company receives the money in fact paying upfront at the time of application is actually a better way to go because this allows coverage to potentially start that day even before the underwriters approve the policy. Yes, there is Special name for this it's called a conditional receipt when the agent collects the application and check the applicant will be given a conditional receipt explaining that the coverage will begin today. There is a hitch though. This early coverage will only be in effect as long as the underwriters ultimately issue the policy and that the premium rates don't need to be increased because of the applicants medical history if the policy isn't issued or if premium rates need to be adjusted higher than the offer for immediate. Coverage gets cancelled any losses that occurred between the issuance Of the conditional receipt and the underwriting decision will no longer be the responsibility of the insurance company. Wait a minute. Let me get this straight. Let's say that you're my agent. I fill out the application for health insurance write you a check and you hand me a conditional receipt a week later. I'm in an accident and have a lot of medical bills to pay but my policy hasn't been approved yet now, even though I have a conditional receipt, I don't know for sure that I'm covered yet. I have to wait until the insurance company tells me whether I'm eligible for a policy and if I need to pay a higher premium Premium if I'm approved and if I don't need to pay a higher premium than my losses will be covered. That's exactly right. I see so coverage is necessarily guaranteed with a conditional receipt and I only get a condition of receipt if I pay their premium up front, right? That's right. If you wait until the time of policy delivery to pay the first premium, then you won't have the chance of being covered at the time of application. All right different scenario. Let's say that my policy has been issued. I've had medical problems that cause my race to be higher. History of asthma two weeks after the policies issued and I've paid the extra premium. I have asthma problems that require extra treatment. These medical bills are covered now, right actually no insurance companies typically imposed coverage limitations on pre-existing conditions. A pre-existing condition is one that has been or should have been diagnosed before the policy was issued. So if my policy was just issued in my asthma started four months ago, then the company won't cover any related medical bills. That's right. Now there will be a point when the company will start covering those losses again. There's usually a probationary period that lasts about six months. This means that if you have a pre-existing condition, you'll have to wait six months before my company will cover any medical expenses related to that illness. That makes sense. All right. Let me see if I can recap all of this first insurance policies are legal contracts the process begins by filling out the application. The agents role is to make sure The client feels it on accurately. If the Asian has any additional information that could help the underwriters. This can be mentioning in the agents report good so far. Perfect. Okay. Now if the applicant writes a check for the first premium at the time of the application the Asian issues a conditional receipt. This means a covered starts on that day. Now if Enduro Riders decide not to issue the policy or to raise a premium amount because the person's medical history, then the conditional receipt is null and void once the policy is issued pre-existing. Auditions are cover for a probationary period of around 6 months. How am I doing? types of policies. Let's take a step back and look at insurance policies in general. These aren't just agreements their bona fide contracts, which means that the promises and right stated in the policy are protected by law the applicant promises to fill out the application as accurately as possible and to pay the required premiums in return the insurance company promises to pay a certain benefit. These legal promises are called consideration. I remember that my house Track was written by someone else and all I had to do was sign some paperwork how our insurance contracts different actually they're handled in pretty much the same way. The Ancients job is to explain the policy and to make sure that the application is filled out accurately as you can imagine. The application is very important because Cuz it's company. What and how much the premium should cost? When the contract is issued its delivered by the agent and the Some weight on the application what if the person lies or accidentally writes the wrong information? Then the insurance company could end up issuing a policy that should be issued at all under any safeguards against this absolutely if an applicant blatantly lies about something major on an application like conveniently forgetting to mention a history of heart attacks than the policy can actually be avoided this false information is called a misrepresentation small misrepresentations might result in an adjustment of benefits. The big ones can actually be grounds for terminating a policy. This is assuming however that the insurance company finds out about the light before the incontestability period begins. What's the incontestability period after a certain amount of time usually two years the statements on an application can't be contested by the insurer. The insurance company would have to honor these claims instead of adjusting or voiding the policy. That's harsh it is that's why we have additional ways of assessing. Person's health and lifestyle for one thing. We can require medical examinations before a policy is issued. And for another thing we can order a report from the medical information Bureau this organizations hold all of the information that fellow ensures have obtained about a person. So if I ask the MIB to send me a report about you, I'll see what kinds of losses other insurers have covered in the past and a history of heart attacks would definitely show up in report like that. All right. Now answer me this let's say that I interview someone who says that he's in perfect health, but I know it's a box of blood sugar testing supplies sitting on the table. When I asked him about this he refuses to give me a straight answer. What would I do? Could I offer the application? Excellent question, you're not allowed to alter the application in any way whatsoever. You'd be asking for big trouble. If you did you can however list your observations in a document called the agents report. This is a report that you right. Turn in with the application. It gives you a chance to voice your opinions and observations. If you see some major red flags, this is how you can report them and who reads the agents report Underwriters these folks make all of the decisions about what is or is not going to be in the contract. Their job is to answer two basic questions first. Are they going to issue a policy to begin with? If so what premium amount will they charge? No, I know that people can pay the first Premium when they turn in the application, how is the price determined? The agent will quote a price from a chart based on the company's normal underwriting criteria or the premium can be paid when the policy is delivered. The bottom line is that the coverage can't start until the agent or insurance company receives the money in fact paying upfront at the time of application is actually a better way to go because this allows coverage to potentially start that day even before the underwriters approve the policy. Yes, there is Special name for this it's called a conditional receipt when the agent collects the application and check the applicant will be given a conditional receipt explaining that the coverage will begin today. There is a hitch though. This early coverage will only be in effect as long as the underwriters ultimately issue the policy and that the premium rates don't need to be increased because of the applicants medical history if the policy isn't issued or if premium rates need to be adjusted higher than the offer for immediate. Coverage gets cancelled any losses that occurred between the issuance Of the conditional receipt and the underwriting decision will no longer be the responsibility of the insurance company. Wait a minute. Let me get this straight. Let's say that you're my agent. I fill out the application for health insurance write you a check and you hand me a conditional receipt a week later. I'm in an accident and have a lot of medical bills to pay but my policy hasn't been approved yet now, even though I have a conditional receipt, I don't know for sure that I'm covered yet. I have to wait until the insurance company tells me whether I'm eligible for a policy and if I need to pay a higher premium Premium if I'm approved and if I don't need to pay a higher premium than my losses will be covered. That's exactly right. I see so coverage is necessarily guaranteed with a conditional receipt and I only get a condition of receipt if I pay their premium up front, right? That's right. If you wait until the time of policy delivery to pay the first premium, then you won't have the chance of being covered at the time of application. All right different scenario. Let's say that my policy has been issued. I've had medical problems that cause my race to be higher. History of asthma two weeks after the policies issued and I've paid the extra premium. I have asthma problems that require extra treatment. These medical bills are covered now, right actually no insurance companies typically imposed coverage limitations on pre-existing conditions. A pre-existing condition is one that has been or should have been diagnosed before the policy was issued. So if my policy was just issued in my asthma started four months ago, then the company won't cover any related medical bills. That's right. Now there will be a point when the company will start covering those losses again. There's usually a probationary period that lasts about six months. This means that if you have a pre-existing condition, you'll have to wait six months before my company will cover any medical expenses related to that illness. That makes sense. All right. Let me see if I can recap all of this first insurance policies are legal contracts the process begins by filling out the application. The agents role is to make sure The client feels it on accurately. If the agent has any additional information that could help the underwriters. This can be mentioning in the agents report good so far. Perfect. Okay. Now if the applicant writes a check for the first premium at the time of the application the Asian issues a conditional receipt. This means a covered starts on that day. Now if Enduro Riders decide not to issue the policy or to raise a premium amount because the person's medical history, then the conditional receipt is null and void once the policy is issued pre-existing. Auditions are cover for a probationary period of around 6 months. How am I doing?

flashcards

completing the application, underwriting, and delivering the policy

43 questions

- Question 1 of 43

- Either on the date of the application or the date of the medical exam (whichever occurs last)

- Either on the date of the application or the date of the medical exam (whichever occurs last)

- Preferred risk

- Only one party makes a legally enforceable promise

- Through interviews with the applicant's associates, friends and neighbors

- Unilateral

- Insurance

- When it may alter the underwriting decision

- The agent's

- Loss

- The Fair Credit Reporting Act

- Underwriting

- Agent/Producer

- Underwriting

- When the policy is delivered and the premium is paid

- An absolutely true statement upon which the validity of the insurance contract is based

- Standard, substandard and preferred

- Provide the applicant a Disclosure Authorization Notice

- When it is intentional and material

- Send the application back to the applicant for signature

- Complete a new application or ask the applicant to initial the correction on the original application

- The process of risk selection and classification

- Personally delivered by the agent or mailed

- When the insurer approves a prepaid application

- Contract of adhesion

- Insuring your own life, the life of a family member, or the life of a business partners or someone who has a financial obligation to the policyowner

- The agent's report discusses the agent's personal observations about the proposed insured that may help in the underwriting process.

- The existence of insurable interest between the applicant and the insured

- Premium

- Policy summary

- At the time of policy delivery

- Agreement (offer and acceptance), consideration, competent parties, and legal purpose

- Investigative Consumer Report

- Risk selection

- A new policy is issued while an existing policy is terminated or reissued with a reduction in cash value

- Insurers

- People who are more likely to submit insurance claims are seeking insurance more often than preferred risks.

- Inspection report

- Insurable interest and consent

- When the insurance application is submitted

- Return the application to the applicant for completion

- The agent

- The policyowner

Congratulations on completing your Flash Cards.

How would you like to continue?

quiz

Languages: EnglishChapter: Completing the Application, Underwriting, and Delivering the Policy

The Exam Breakdown in the Introduction shows how many questions will be on your exam, and how many of them will be allocated to each chapter on the practice tests and on the state exam. Consult this breakdown and manage your study time accordingly.

A list of Terms to Know at the beginning of each chapter will help you better understand important insurance-related concepts presented in the chapter. Sometimes, terms you are familiar with in regular life have a unique meaning when applied to insurance, so review these terms and definitions.

Study Tips

- Always take notes. This will help you to actively engage in the learning process and solidify concepts in your memory.

- If you are studying with the textbook, answer the Snapshot questions at the beginning of each chapter first on your own, and then confirm your answer in the text (the answers are also provided at the end of the Study Guide).

- Make a reference sheet. This will allow you to have a quick focused review at the end of a chapter or the course.

- If you are struggling with some concepts, take an open-book chapter quiz. This will encourage you to seek out answers, analyze information, and apply that knowledge. Once you have to work for it, you will remember and understand the concepts better.

- Take a break from studying. If you have been studying a lot, but feel like you’re having trouble remembering the information, take a couple of days off. When you return, Simulate Your Exam and see how you do. Go back and review any areas you have trouble with. Take notes!

- Keep the information fresh in your mind. Study up until the day before your exam. If you are unable to take the state exam right after you have completed your studies, you should re-start the study and review process. It is better to delay taking the exam than to take it unprepared.

F. Exam Breakdown

Tennessee Life Insurance Examination

82 Total Questions (68 scored, 14 pretest)

| Chapter | Percentage of Exam |

| GENERAL KNOWLEDGE: | |

Completing the Application, Underwriting, and Delivering the Policy | 18% |

Types of Life Policies | 18% |

Policy Provisions, Riders and Options | 26% |

| Taxes, Retirement, and Other Insurance Concepts | 12% |

| STATE LAW: | |

| Tennessee Laws, and Departmental Rules Common to All Lines | 20% |

| Tennessee Laws and Departmental Rules Pertinent to Life Insurance Only | 6% |

Accurate underwriting depends heavily on an application that is complete and representative of the potential risks. This chapter focuses on the producer's first major role as a field underwriter: completing the application and delivering the policy. This section discusses the specific steps of the application process, which includes completing the form itself, collecting the premium, and delivering the policy. In general, this chapter helps you build a foundation of insurance concepts that make it easier for you to master the rest of the material in this course.

TERMS TO KNOW | |

Adverse selection — insuring of risks that are more prone to losses than the average risk | |

A. Key Concepts and Definitions

Insurance is a transfer of risk of loss from an individual or a business entity to an insurance company, which, in turn, spreads the costs of unexpected losses to many individuals. If there were no insurance mechanism, the cost of a loss would have to be borne solely by the individual who suffered the loss.

| Know This! Insurance is the transfer of risk. Insureds' losses are transferred over to the insurer. |

The term insurance transaction includes any of the following (by mail or any other means):

- Solicitation;

- Negotiations;

- Sale (effectuation of a contract of insurance); and

- Advising an individual concerning coverage or claims.

B. Types of Insurers

Insurance companies can be classified in a variety of ways based on ownership, authority to transact business, location of incorporation (domicile), marketing and distribution systems, or rating (financial strength).

As you read about different classifications of insurers, keep in mind that these categories are not mutually exclusive, and the same company can be described based on where it is located and allowed to transact the business of insurance, who owns it, and what type of agents it appoints.

Stock companies are owned by the stockholders who provide the capital necessary to establish and operate the insurance company and who share in any profits or losses. Officers are elected by the stockholders and manage stock insurance companies. Traditionally, stock companies issue nonparticipating policies, in which policyowners do not share in profits or losses.

A nonparticipating (stock) policy does not pay dividends to policyowners; however, taxable dividends are paid to stockholders.

Mutual companies are owned by the policyowners and issue participating policies. With participating policies, policyowners are entitled to dividends, which, in the case of mutual companies, are a return of excess premiums and are, therefore, nontaxable. Dividends are generated when the premiums and the earnings combined exceed the actual costs of providing coverage, creating a surplus. Dividends are not guaranteed.

Before insurers may transact business in a specific state, they must apply for and be granted a license or Certificate of Authority from the state department of insurance and meet any financial (capital and surplus) requirements set by the state. Insurers who meet the state's financial requirements and are approved to transact business in the state are considered authorized or admitted into the state as a legal insurer. Those insurers who have not been approved to do business in the state are considered unauthorized or nonadmitted. Most states have laws that prohibit unauthorized insurers from conducting business in the state, except through licensed excess and surplus lines brokers.

| Know This! Insurers must obtain a Certificate of Authority prior to transacting business in this state. |